corporate tax increase canada

Under the previous governments plans the rate of Corporation Tax was to increase from 19 to 25 from April 2023 for firms making more. In the long-term the Canada Corporate Tax Rate is projected to trend around 2650 percent in 2021 according to.

New report compiles 2021 corporate tax rates around the world and compares corporate tax rates by country.

. The tax provisions of the FY23 budget are intended to. The corporate tax rate on large financial institutions mostly banks and life insurers would climb three percentage points to 18 from 15 and apply to earnings above 1. Insights and resources.

Furthermore a corporation pays tax on its taxable income earned worldwide while a foreign corporation pays tax on its taxable income earned in Canada. Puerto Rico follows at 375 and Suriname at 36. See the latest 2021 corporate tax trends.

Related

Bidens proposal to increase corporate rates to 28 up from. Canadian personal tax tables. Tax rates are continuously changing.

To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an. The Ways and Means Committee Subtitle I would increase the corporate tax rate from the current federal rate of 21 percent to 265 percent. Based on the statistical results a one percentage point drop in the combined corporate tax rate would increase the average wage of Canadian workers by between 254.

Get the latest rates from KPMGs personal tax. Published 23 September 2022. The most important proposal for companies is the possible increase in the corporate tax rate from 21 to 28.

Small businesses currently benefit from a reduced federal tax rate of 9 per cent on their first 500000 of taxable income compared to a general federal corporate tax rate of 15. Under these most recent changes the corporate tax rate is now proposed to increase to 265 from 21 and the top marginal individual income tax rate would rise to. Corporate Tax Rate.

Financial institutions that qualified for the 07 capital tax rate in taxation years ending after 31 October 2008 and before 1 November 2009 are subject to a 07 capital tax. Excluding jurisdictions with corporate tax rates of 0 the countries with the. Comoros has the highest corporate tax rate globally of 50.

New Tax Rules For Canadian Controlled Private Corporations Madan Ca

Worthwhile Canadian Initiative Statutory And Effective Corporate Tax Rates Across Countries

Corporate Tax Rates In Selected Countries Download Table

Economic Growth And Cutting The Corporate Tax Rate Tax Foundation

Major Changes To Canada S Federal Personal Income Tax 1917 2017 Fraser Institute

Canadians Pay More Income Tax Than Americans Wealth Professional

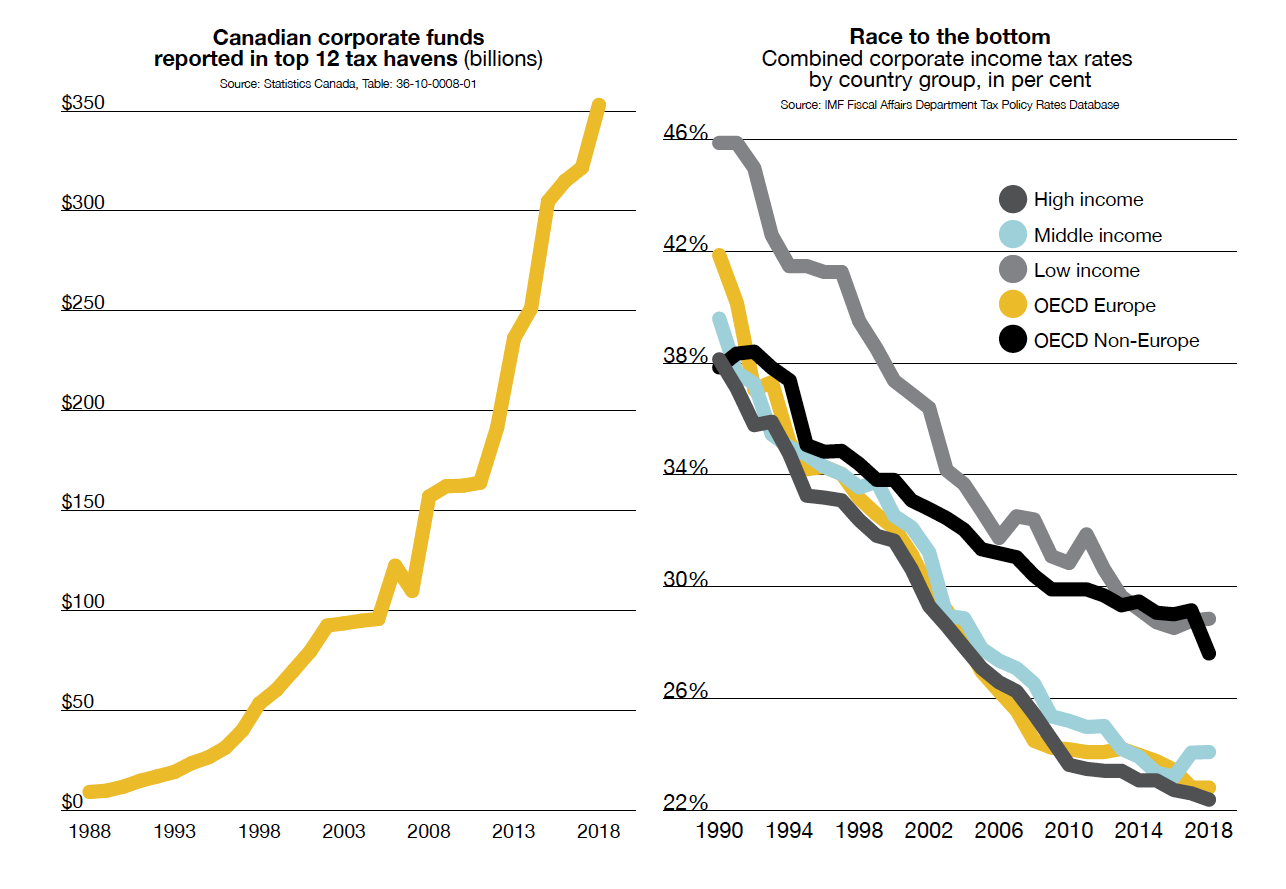

The Failure Of Corporate Tax Cuts Canadian Union Of Public Employees

Canada And Weighted Average General Corporate Income Tax Rates Among Download Scientific Diagram

Updated Corporate Income Tax Rates In The Oecd Mercatus Center

Real World Examples Of More Revenue With A 15 Corporate Tax Rate

Worthwhile Canadian Initiative Trends In Oecd Corporate Income Tax Rates

Corporate Income Tax Cameron Graham

Tax Foundation On Twitter President Biden S Americanjobsplan Looks To Increase The Federal Corporate Tax Rate To 28 Which Would Raise The U S Federal State Combined Tax Rate To 32 34 Higher Than Every Country

Marginal Effective Tax Rates Canada Ca

The Tax Cut America Can T Do Without Washington Times

April 1st Is No Joke For U S Workers

Canada S Corporations Have Already Earned Enough To Pay Their Income Taxes For The Year Huffpost Business

Hungary To Drop Corporate Tax To Lowest In Europe Taxlinked Net

Can Japan Afford To Cut Its Corporate Tax